- Home

- >

- Commodities Daily Forecasts

- >

- WTI and Brent under fire after an EIA report

WTI and Brent under fire after an EIA report

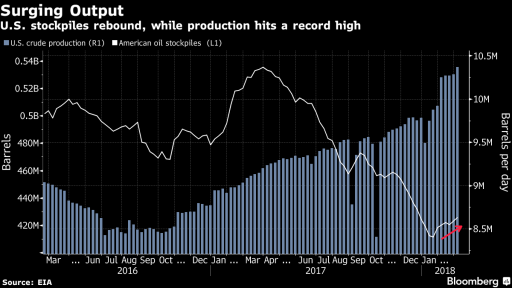

Oil slid in New York amid concern that global demand might not absorb swelling U.S. supplies. Futures fell as much as 1.8 percent to a session low of $60.27 a barrel, after fluctuating in morning trading. The U.S. government expects major shale regions to boost output by 131,000 barrels a day in April, spurring fears that surging supplies will undermine OPEC’s efforts to clear a glut. Sentiment is being soured further by a forecast increase in U.S. inventories, a third consecutive weekly gain.

“The EIA report yesterday about the expected increase in shale output next month certainly weighed on things,” John Kilduff, founding partner at Again Capital, said in a phone interview.“And apparent discourse among OPEC producers, specifically the Iranians, is showing that the patience is running out with the accord, partly because of what the shale players are doing in terms of grabbing more market share.”

Oil has struggled to recover losses from last month’s broader market slump after topping $66 a barrel in January. While a brighter economic outlook has underpinned demand expectations, expanding American production remains a challenge to the Organization of Petroleum Exporting Countries and its allies, which are trying to prop up prices via output curbs.

U.S. crude inventories probably expanded by 1.9 million barrels in the week through March 9, according to a Bloomberg survey before EIA data on Wednesday. Meanwhile, stockpiles at Cushing, Oklahoma, the delivery point for WTI futures, probably held steady after 11 straight weeks of declines.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.