- Home

- >

- Commodities Daily Forecasts

- >

- Yellen surprises hedge funds who cut gold bets before rally

Yellen surprises hedge funds who cut gold bets before rally

Janet Yellen’s soothing words on the pace of U.S. interest rate hikes were a day late for hedge funds losing faith in the metal.

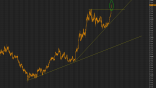

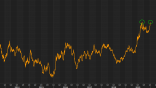

Money managers cut their bullish bets on bullion by the most since 2015 in the week ended March 14. The next day, Federal Reserve Chair Yellen reiterated that monetary policy will remain accommodative for “some time,” easing market fears that there might be more than three rate hikes this year. Her words sparked the biggest gold rally since November.

Gold, which climbed through the first two months of the year, had foundered in March as the prospect of higher borrowing costs curbed the appeal of non-interest-bearing assets. Yellen’s remarks came as the Bank of Japan maintains its unprecedented monetary easing program and the Bank of England holds its benchmark rate at a record low, helping to keep yields on trillions of dollars worth of debt below zero.

The funds reduced their gold net-long position, or the difference between bets on a price increase and wagers on a decline, by 47 percent to 49,835 futures and options contracts in the week ended March 14, according to U.S. Commodity Futures Trading Commission data released three days later. That was the biggest decline since December 2015.

As traders awaited the Fed meeting, gold futures in New York dropped in the first part of last week. Yellen’s statement on March 15 then reversed those losses, sending the metal up 2.5 percent to $1,230.20 an ounce at the close on March 17, the biggest two-day gain since Nov. 2. On Monday, it rose as much as 0.3 percent to $1,234.40.

The negative yields give an advantage to gold, which some investors consider a store of value and a hedge against inflation.

There are other tailwinds supporting bullion. Standard Chartered Plc analyst Suki Cooper said political uncertainties from the French elections to the U.K.’s formal exit from the European Union will bolster haven demand. Price dips toward $1,200 are “attractive entry levels,” she said in a report March 16. A pick up in seasonal demand from India also limits the downside risk in the near-term, Cooper said.

Gold imports by India, which competes with China for the role of world’s biggest consumer, jumped 175 percent to 96.4 metric tons in February from a year earlier, according to a person familiar with provisional data from the finance ministry who asked not to be identified as the data aren’t public.

The precious metal’s rebound has also been driven in part by risks to global growth, the lack of clarity on U.S. tax reform and “persistent doubts” about the U.S. infrastructure plan by President Donald Trump, Morgan Stanley analysts including Tom Price wrote in a note March 13. Still, they said they remain “long-term bears because of stable global growth, and “pro-active inflation management.”

Source: Bloomberg

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.