- Home

- >

- Commodities Daily Forecasts

- >

- Investors are hittinh the “Exit Button”” on GOLD

Investors are hittinh the "Exit Button"" on GOLD

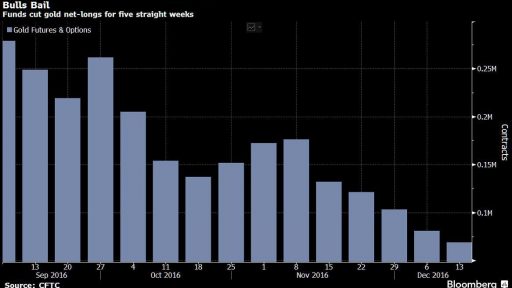

With Gold Prices Stuck in ‘Purgatory,’ Hedge Funds Hit the Exits .Net-long position in metal drops for fifth straight week $6.2 billion pulled from precious metals ETFs in month.

Prices have fallen for six straight weeks, the worst streak in a year, as prospects for higher U.S. borrowing costs damped demand for gold, a non-interest-bearing asset. Investors don’t seem too optimistic about the outlook for 2017. Hedge funds cut their bets on a rally to the lowest since February, while outflows are ramping up from exchange-traded funds.

After the metal’s best first half since 1979, bullion has been losing its luster as U.S. equities rallied to records. A stronger dollar and rising bond yields have also crimped demand for the alternative asset. Federal Reserve officials last week signaled a steeper path for interest rates in 2017, after raising borrowing costs for the first time this year. While money managers have cut their wagers on a gold rally for five consecutive weeks, their net-position is still more than double what it was at the end of January.

“People are still too optimistic on gold,” said John LaForge, the Sarasota, Florida-based head of real assets strategy at Wells Fargo Investment Institute. “We’re in a price purgatory for a lot of commodities, including gold. You’re going to have a lot of investors and strategists like myself reduce their price forecasts.”

The net-long position, or bets on price gains, for gold declined 15 percent to 68,905 futures and options contracts in the week ended Dec. 13, according to U.S. Commodity Futures Trading Commission data released three days later. The holdings are down 61 percent over the five-week slump.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.