- Home

- >

- Commodities Daily Forecasts

- >

- Oil fundamental and inertia can push prices to new highs

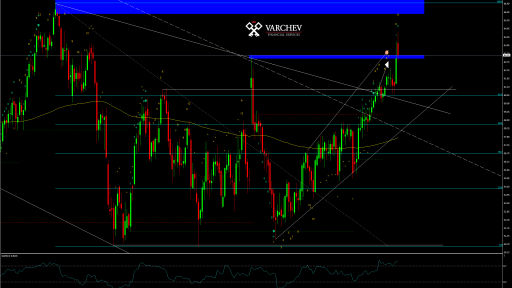

Oil fundamental and inertia can push prices to new highs

The situation in the Middle East “is not going to get dramatically better in the short term,” said Robert Horrocks, chief investment officer at San Francisco-based Matthews Asia, an investment firm with $27.5 billion under management.

A continued rise in oil prices could cause consumers to pull back on spending. “That might be enough to tip the U.S. into a mild recession,” Mr. Horrocks said.

U.S. oil producers could profit from the higher crude prices, said Bjarne Schieldrop, chief commodities analyst at SEB Markets. But those gains would likely be negative for the average American.

“When crude goes up, typically the gas price goes up as well,” he said, though he wouldn’t expect a strong spike given other countries could scale up production.

Among the S&P 500 sectors, energy added 0.3%, the second-biggest sector winner, after communications services. Shares of Occidental Petroleum rose 2.4%.

Airlines stocks fell, meanwhile, as investors worried about higher jet-fuel prices and slower economic activity. American Airlines Group dropped 1.5% and Delta Air Lines declined 1%.

The concern for oil markets isn’t limited to the Gulf region, said Ole Hansen, head of commodity strategy at Saxo Bank. Turkey’s parliament recently authorized the government to dispatch troops to Libya, which produced about 1 million barrels of oil a day in 2019.

“We are in a period of extreme uncertainty,” he said. “The global economy is not that strong and a spike in oil prices is not good for growth.”

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.