- Home

- >

- Commodities Daily Forecasts

- >

- A new high for WTI after Trump’s intention to hit Syria – what’s next

A new high for WTI after Trump's intention to hit Syria - what's next

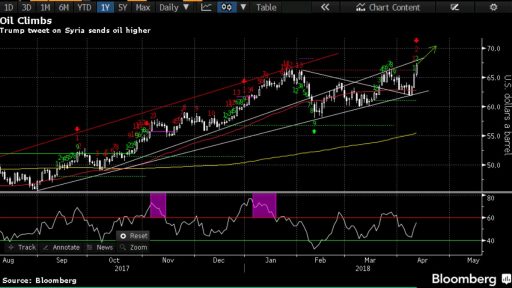

Light crude oil futures (WTI) hit a new high after Trump announced his intentions to hit Syria as never before.

Technical view on WTI

Double Top? No, this time! If we have to compete with the technical analysis and the foundation, then the foundation found a point, defeating the technical formation. Against the background of attacks between Russia and the United States, black gold marked a new high while at the same time signaling a subsequent upward impulse. Let's look at the pros and cons of the situation. From the point of view of Price Action, we have a formation of three white soldiers showing the strength of the bulls. 50 and 200SMA are beached, the last correction being up to 50 periodic, followed by a strong rebound upwards. We have a breakthrough on a horizontal level of resistance - already support. What do indicators indicate? DeMarker points up and is still far from overproduction - the upward pulse is in effect. Sequential counts the 2 on top of the possible 13-current upward wave is at the beginning. From a purely technical point of view, what we have to worry about is the inner trend line that still holds up on growth. Given the foundation, however, I think it would not be a problem with a possible US strike on Syria in the next 24 hours.

Is the situation current? Yes, but too risky due to the fact that traders have already accumulated a hit in Syria, and this creates uncertainty about the price response in a real blow. Taking into account the White House's actions, as well as the proliferation of troops in the Middle East, it seems that it is a matter of time that the conflict escalates.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.