- Home

- >

- Commodities Daily Forecasts

- >

- China is overtaken by a “golden fever”

China is overtaken by a "golden fever"

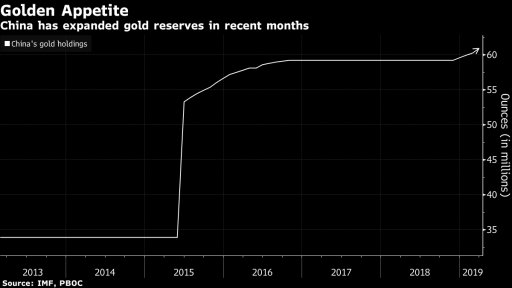

The second largest economy in the world has expanded its gold reserve for the fourth consecutive month. This only has a good effect on the sentiment that central banks around the world continue to accumulate stock of gold.

PBOC raised its reserves from 60.26 million ounces in February to 60.62 million ounces in March. In tons, that means 11.2 tons of gold were added last month, and 9.95 tons were added in February.

China, the world's largest gold producer and consumer, is meeting economic clashes, despite significant progress in the trade talks with the United States. According to the latest PBOC data, the government has resumed adding more gold to its reserves at a steady pace. If China continues at that rate by the end of 2019, the state will overtake Russia by the amount of gold in reserve.

Governments around the world have added 651.5 tonnes of gold in 2018. Russia has increased its reserves fourfold within a decade, and this move has been triggered by Vladimir Putin, who has decided to "break" his ties with the US dollar.

In March, the price of gold fell after the Fed's comments that it would slow down until the end of the year. This led to a jump in stocks. However, in the long run, the prospects for gold remain bullish. The price finds support with the increase in reserves of reserves, which are growing every year. Goldman Sachs are expecting a gold rally to $ 1450 over the next 12 months.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.