- Home

- >

- Commodities Daily Forecasts

- >

- Commodities: Copper and Aluminum ready for further fall

Commodities: Copper and Aluminum ready for further fall

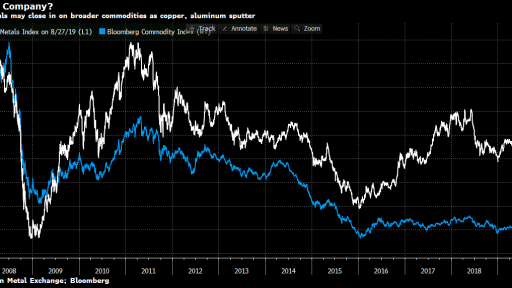

Copper and aluminum, which are in addition to the two most important industrial metals, are also a leading indicator of economic activity. For some time now, both metals have been gaining more and more attention from investors, but in a negative way, suggesting that we are approaching a slowdown in the global economy.

Although China had a plan to increase its demand for cars and promised that tariffs would not affect, the reality was different. The two metals marked a lower bottom in the background of the perceived economic slowdown not only in China but also in Europe. In addition to the negative foundations around Aluminum, we can add the repeal of US sanctions against United Co. Rusal is the world's second largest aluminum producer. In other words, the trend remains short.

Let's look at the Aluminum Daily Chart

After testing the 50-day average with a 23.6% Fibonacci retracement, the price registered a new Low, confirming the main short trend, which opens opportunities for Short-traders. Given the highly negative foundation around the metal, I expect a downward trend test on the main downward channel, followed by a correction to the horizontal area of resistance. This is where it is good to look for opportunities for short positioning with a trend.

Alternatively, if the price goes above the horizontal resistance area, the aggressive negative scenario will collapse and we are more likely to observe a test of the upper diagonal of the downward channel.

Chart: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.