- Home

- >

- Commodities Daily Forecasts

- >

- Cotton Reaches Highest Since 2014 on Demand for U.S. Exports

Cotton Reaches Highest Since 2014 on Demand for U.S. Exports

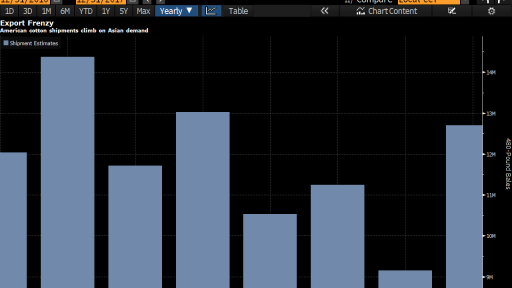

Cotton futures jumped to the highest in more than two years on bets that robust demand will continue for supplies from the U.S., the world’s biggest exporter.

American shippers have already committed to sell 86 percent of this season’s total expected exports, up from 72 percent a year earlier, government data showed last week. Purchases were led by Vietnam and China, the world’s top consumer.

Prices have climbed for four straight weeks amid the pickup in global demand. U.S. farmers are reaping the benefits after supply disruptions in growers including India, the No. 1 producer. The U.S. National Cotton Council on Feb. 11 said world consumption may top production for a third straight year in the season that starts Aug. 1, further trimming global stockpiles.

Hedge funds are holding the biggest wager on record that cotton futures will keep rallying.

“A lack of exportable supplies in Central Asia and West Africa, coupled with India’s reduced exports, are supporting current prices,” the Cordova, Tennessee,-based council said in a presentation on its website.

Cotton for May delivery rose 1.5 percent to settle at 78.21 cents a pound Monday on ICE Futures U.S. in New York after touching 78.45 cents, the highest since June 2014. Aggregate trading volume was more than double the 100-day average for this time, according to data compiled by Bloomberg. The fiber has advanced about 11 percent in 2017 after climbing the past two years. Supplies have dropped from India after Prime Minister Narendra Modi’s surprise move last year to withdraw and replace high-denomination banknotes. The move dented farmer confidence as they largely sell their harvest for cash.

In India, “export sales are reportedly being canceled due to rising prices and tightness of supply that is lingering,”

Louis W. Rose, an industry consultant in Memphis, Tennessee, said in a report Monday.

In the week ended Feb. 7, money managers boosted the net- long position, or the difference between bets on a price increase and wagers on a decline, by 7.3 percent to 100,340 futures and options, U.S. Commodity Futures Trading Commission data show. That’s the highest since records begin in 2006.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.