- Home

- >

- Commodities Daily Forecasts

- >

- Everything we need to know about the oil market in 2018

Everything we need to know about the oil market in 2018

Over the last two years, there is no doubt a serious race for the oil market. Somewhat aroused by the US's drive to become a leader in shale oil exports, and partly because of the craze of electrification of much of the vehicle, the price of oil collapsed to record low prices. OPEC then intervened through its short-term mining program, involving both countries and outside the organization. Recent data on the success of the abstraction program show that OPEC + (OPEC + countries participating in the abstraction agreement) almost achieved its goal. With these actions, they have significantly increased the cost of raw materials and have prompted US Drills to drastically increase shale yields. As a result, shale oil yields reached record levels of 7,560 million barrels per day.

The latest oil census data in the United States shows a growth of 26 new platforms, with a total of 791. New gas fields are up 3 more compared to a week earlier, reaching 184.

Considering the data above, it is good to mention the fact that the United States surpassed Saudi Arabia, one of the world's top oil drilling companies. The latest data from the US Department of Energy shows that US mining has reached 10,271m. barrels a day, of which 7.56 million. barrels are from shale deposits.

Total production of large US shale companies is expected to rise by 110,000 barrels per day to a record 8.76 million barrels a day in March, according to Energy Information Administration estimates. Permian's production will increase by 75,000 barrels per day to 2.99 million barrels per day. According to OPEC President Suhail Al-Mazriuei, the increase in shale production will not lead to drastic changes in oil prices.

In addition to OPEC+'s efforts to raise oil prices in recent months, USD also contributed to the growth of black gold. The weak dollar favors the rise in oil as it trades with US dollars. A large majority of analysts believe the dollar will appreciate in 2018. against the backdrop of the expected 4 interest rate rises on the part of the Fed, strong economic growth and high inflation. Despite these expectations, however, the USD marks bottom after bottom and this further supports the raw materials.

What to expect?

The latest production report published by the US Energy Ministry was surprisingly revised and the US yield forecast adjusted. The ministry's expectations are extremely positive, with US mining reaching 11 billion barrels a year earlier than anticipated in November 2018. This puts a huge question on the OPEC + agreement and the already exiting treasury of producer countries.

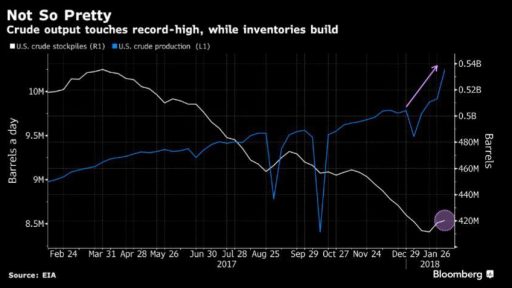

If we compare the chart of US production, which has made it clear that it will grow, we will see with stocks that stocks have something to catch up with. US stocks have a very strong impact on oil prices and if we see stock growth again to levels above 10m barrels, WTI will have a good foundation to drop below $50.

There is another oil question mark in Asia. At the end of March, China will release oil futures denominated in Chinese Yuan. If futures are accepted by investors and become a benchmark for global oil transactions, China hopes their local currency will be able to oppose the dominance of USD in global trade. What we need to know is that China has already surpassed the US on import and consumption of oil. The nation has also accumulated millions of barrels for its strategic oil reserve.

"The ability of foreign manufacturers and consumers to enter into hedging contracts in China's domestic market using the yuan completely changes the game," said John Browning of Shanghai-based BANDS Financial Ltd.

"Besides consumers and manufacturers, investors and commodity markets arbitrage of Chinese futures commodity markets have deep liquidity reserves that international traders have been looking for for many years to come," Browning said.

How will OPEC+ turn off all this?

The only option for Member States in the cartel is to increase redundancies. However, this will not appeal to Russia, which is opposed to the fact that the US occupies an increasing part of the oil market. On the other hand, the smaller countries in the organization are already having serious difficulties in successfully filling their budgets as their exports have dropped dramatically. The next OPEC meeting will take place on 22 June in Vienna, and market participants expect it to be very controversial. We expect major producers such as Saudi Arabia and Iran to request an extension of the abstraction program after the end of 2018. or increase the volume of redundancies. On the other hand, as we have mentioned, there will be Russia and smaller producers, which hardly cover budget deficits. Ultimately, it is unlikely that a final decision will be reached, and that would lower the price of black gold

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.