- Home

- >

- Commodities Daily Forecasts

- >

- Expectations for record shale yield in February, can we expect a reversal of oil?

Expectations for record shale yield in February, can we expect a reversal of oil?

US Shale Oil Drills are expected to record another record-breaking month in February. The forecasts are for the State Energy Ministry, and according to the data available to the institution, oil production in the largest oil regions in the country is expected to grow by 111,000 barrels to 6.55 million. barrels per day.

Looking at the graph, it is noticeable that the shale industry is taking an increasing share of total US production, and the upward trend over the past year seems to be no longer developing.

Adhering to the trend, companies in the Peruvian, Texas and New Mexico will earn the most profits, with the yield there increasing by 76,000 barrels per day.

The Eagle Ford region in Texas is also expected to increase the yield by 15,000 barrels. North Dakota's production will grow by 8,000 barrels, and companies in the Niobrara, Colorado region will increase production by 6,000 barrels a day.

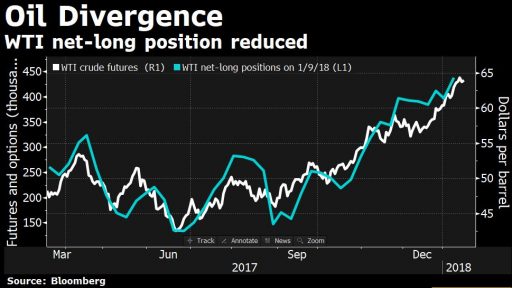

The total US oil yield is expected to hit 10.3m barrels per day, and this will be the highest value ever achieved. Taking these figures into account, we expect the oil price to stay below $ 65 a barrel with very strong fundamental support, the upward trend to end and to see a decline in 2018. Looking at the Chicago futures markets, it's clear that the net long positions at WTI have dropped in the past week. This means that large manufacturers using futures to secure a better price start accumulating higher yields in advance.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.