- Home

- >

- Commodities Daily Forecasts

- >

- The depreciation of oil implies unpredictable moves on the part of manufacturers

The depreciation of oil implies unpredictable moves on the part of manufacturers

The leaders of the world's 20 largest economies will meet in the capital of Argentina at the weekend, where they will try to reach consensus on important issues. A week later, the long-awaited meeting between OPEC and outside producers in Vienna will be held on December 6th.

The important meeting between OPEC and its partners in early December can easily become a formality, analysts say before CNBC. The world's most influential players in the oil market are likely to shed more light on their upcoming actions

"All eyes are on the forthcoming OPEC meeting, but the event can easily become a formality," Tamas Varga, chief analyst at PVM Oil Associates, said on Tuesday. "When oil ministers of producing countries gather together a week later in Vienna, they will just do the formal arrangement this weekend at the G-20 summit."

There is no doubt that the alliance between OPEC and non-member countries will continue.

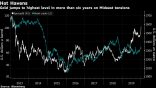

Oil prices dropped more than 25 percent after rising to a four-year high in early October. The sharp downturn has increased tensions over the OPEC Union to organize new supply reductions.

European Brent crude oil traded for $ 59.71 a barrel Wednesday afternoon, about 0.8 percent less, while crude WTI remained at $ 51.16, about 0.75 percent lower.

Saudi Arabia, which is a major participant in OPEC, is pushing for the oil cartel to cut production in order to reduce concerns about overproduction. Earlier in the month, the country promised to do everything necessary to prevent stockpile saturation.

Russia seems unconvinced to sign a change in the production strategy. The country warns the OPEC group that they must be careful to ensure that it does not change extreme changes in the situation.

US President Donald Trump, who is a public proponent of low oil prices, has advised OPEC not to cut production.

"The deal between OPEC and its partners is definitely a result, because there is an opportunity to stabilize oil prices, which is good for both producers and consumers. Undoubtedly, this cooperation will continue and this will bring positive results not only for the Saudi and Russian economies but also for the world economy because the big fluctuations in oil prices are not good for predicting global economic growth. "- says Kirill Dmitriev, executive director of the Russian direct investment fund.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.