- Home

- >

- Commodities Daily Forecasts

- >

- Gold is becoming the best hedge against geopolitical risks

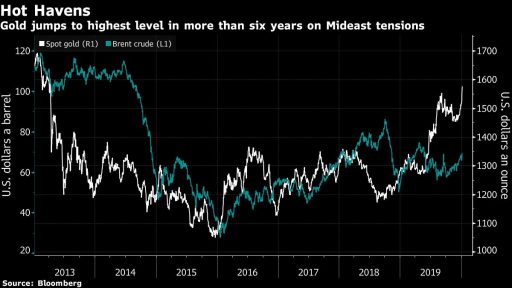

Gold is becoming the best hedge against geopolitical risks

Gold rose to levels last seen in 2013 with tensions rising in the Middle East. This has boosted demand for safe heaven assets, with Goldman Sachs saying gold still has room to rise. Palladium also reached new peaks.

Gold is approaching $ 1,600 an ounce, and the gold rally has intensified after Tehran said they would no longer abide by restrictions on their nuclear program. President Donald Trump also said he is ready to strike Iran in an "unpredictable way" if it strikes US positions in the region.

Precious metal can be a better bet instead of oil against a backdrop of tensions.

"History shows that in most cases, gold in such situations goes up well above its current market levels." - said Jeffrey Currie and Damien Courvalin of Goldman Sachs. This is supported by their thesis that gold is a better hedge against geopolitical risks.

If the situation escalates further, gold could go up to $ 1600 and beyond, according to UBS Group and ABN Amro Bank.

The recent rally has put the price of gold in overbought territory, with the RSI of gold reaching 87.

Even as the situation escalates and drives another momentum up, there is a risk that this rally will be temporary, with liquidity normalizing.

"Investors are starting to come back from vacation and see that the gold price is $ 100 up from when they left." - says Georgette Boele of ABN Amro.

Gold is also rising amid rising demand at its strongest pace since 2010, driven by the trade war, the weakening of the global economy and the lighter monetary policy of central banks. The price is supported by strong demand from central banks and ETFs in gold.

The Fed is not expected to raise interest rates over the next six months, which is likely to impose some restriction on the dollar to how much it can go up - these two factors are positive for gold.

Palladium also goes up in price with gold, but there is an individual positive foundation around the metal itself. Tighter carbon standards have created a serious metal deficit, which has led to a significant increase in the cost of the resource. At a spot price, it is trading just over $ 2000 an ounce of LSE.

Analysts expect that the price will continue to rise, because demand is significantly ahead of supply. Silver is also rising in price, with more than $ 18.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.