- Home

- >

- Daily Accents

- >

- Farm Markets Hit as Brazil Chaos Sends Sugar, Soy Tumbling

Farm Markets Hit as Brazil Chaos Sends Sugar, Soy Tumbling

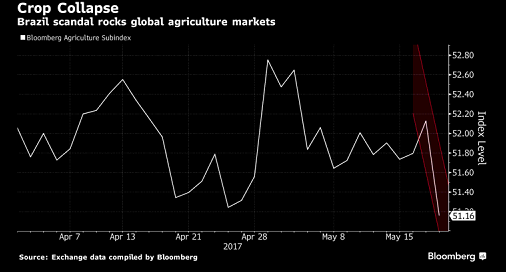

Crop prices are collapsing in the wake of the political crisis in Brazil, a commodity powerhouse

that’s the world No. 1 exporter of soybeans, sugar, coffee and orange juice. Brazilian tumult

sent the nation’s currency tumbling. A weaker real increases the appeal of Brazil’s main

commodity exports, driving additional supply to the market. At the same time, controversy

surrounding Donald Trump has sparked political upheaval in the U.S.

The Bloomberg Agriculture Subindex posted its biggest intraday loss since August.

Raw sugar slumped more than 4 percent and soybeans fell to a one-month low.

Trading volumes surged across most farm products.

"Funds are leaving positions in commodities to protect themselves from uncertainties

involving not only Brazilian political turmoil, but also the latest events involving U.S.

President Donald Trump," Steve Cachia, an analyst at brokerage firm Cerealpar, said in a

telephone interview.

Brazilian markets were thrust into turbulence after reports that President Michel Temer

was embroiled in an alleged cover-up scheme. The benchmark Ibovespa index of equities

and futures on the real plunged so much that the declines triggered trading halts.

In the U.S., there were fresh revelations about undisclosed contacts between

Trump’s campaign and the Kremlin, adding to concern about the administration’s policy

agenda.

The Bloomberg Agriculture Subindex dropped 1.4 percent to 51.3877 after falling as much

as 2 percent, the most since Aug.

There could be more losses on the way.

"We’re not seeing a soybean sales explosion so far,” Cachia said. “Even though the real

has fallen a lot since yesterday, there’s a speculation that it can drop further regarding

the gravity of Brazil’s political crisis," and that could trigger more crop selling, he said.

Here’s a closer look at some of the markets:

* Soybean futures for July delivery fell as much as 2.6 percent to the lowest since April 18

on the Chicago Board of Trade.

Trading volume was more than double the 100-day average for the time of day.

Bearish soybean options surged.

Raw sugar dropped for the first time in four days on ICE Futures U.S. in New York.

Arabica coffee and orange juice also slumped.

July corn futures headed for the biggest loss in a week on the CBOT.

Source: Bloomberg Pro Terminal

Senan Fuchedzhiev - Trader

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.