- Home

- >

- Commodities Daily Forecasts

- >

- Gartman says gold is in a true bull market—and on its way to $1,500

Gartman says gold is in a true bull market—and on its way to $1,500

Gold has enjoyed a spectacular beginning to 2016, and one widely followed commodities expert believes the metal could be on the verge of going much, much higher.

"I think it's still a bull market," said Dennis Gartman, editor of The Gartman Letter, Monday on CNBC's "Fast Money." He predicts gold could finish out the year 10 to 15 percent above current levels.

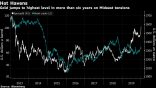

With gold hitting a 15-month high Monday and breaching $1,300, that would represent a price as high as nearly $1,500.

Even though he granted the precious metal tends to get to "big, round numbers" like $1,300 and "back off," Gartman said the fundamental case remains intact, due to central bank policies.

"I think the monetary authorities around the world, with the exception of the United States, are continuing to err on the side of easier monetary policies," he said.

Easy monetary policies tend to make a country's currency less valuable, potentially leading investors to turn to gold as a store of value. In addition, the low interest rates engendered by these policies make the yellow metal relatively more attractive, since it means investors aren't missing out on much by holding a nonyielding asset.

For these reasons, Gartman is confident that the bear market in gold is officially over, even though it's still down about 33 percent from its 2011 peak.

"Normally one wants to think that a bull market in equities gives way to weaker gold prices, but that's not necessarily true. If the monetary authorities are in fact easing ... that could still make the case for a stronger stock prices and for stronger gold," he said.

Gartman makes the case for owning gold in yen, euro and dollar terms in order to reap the biggest benefits from the rally. He urges investors to be in these spots in any correction that may emerge.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.