- Home

- >

- Commodities Daily Forecasts

- >

- GOLD broke a major resistance

GOLD broke a major resistance

GOLD

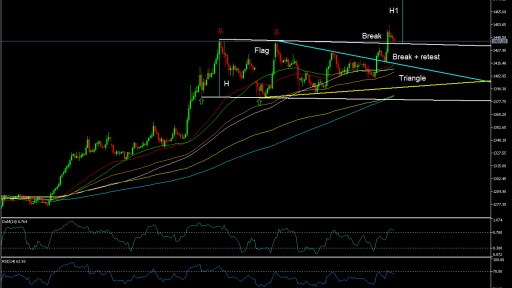

Time frame: H4

Technical analysis: The gold chart shows an exceptionally strong upward trend. After the price managed to record a peak at $ 1440, the price entered into consolidation, forming a distinct "Flag" figure. This type of figures are trend continuation and given the strong upward trend, the formation can be accomplished. On 18.07.19 the price managed to break through two main resistances, the resistance of the triangular consolidation (the blue trend line) and the most important resistance that is on the flag (the white trend line). Currently, the price is above them and consolidates, indicating that the breakthrough can be sustainable and the upward movement continues.

Possible options for entering a deal:

Option 1: The price reaches the pierced resistance of the flag and fails to return under it. This would indicate that the breakthrough is real and the price will continue to meet the target. Here you can position yourself with "buy" orders.

Option 2: The price returns under resistance and makes a retest that fails to break it upwards. This would signal that the flag consolidation is again active and the downward movement will continue. Here we can position ourselves with "sell" orders.

Indicators: At this stage, RSI and DeM are around their over-bought values. which signals that the upward movement may soon end.

At this stage all moving averages play a role in supporting the price.

Trader Milko Zashev

Trader Milko Zashev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.