- Home

- >

- Commodities Daily Forecasts

- >

- “Gold Fever” is overwhelming the investors

"Gold Fever" is overwhelming the investors

Gold, which has been criticized for lack of profitability and practical benefits, offers something that no longer offer negative yields - protection from inflation. In addition, gold is a great choice for hedging with this yield on bonds.

Central banks, in an attempt to restart economic growth, are beginning to squeeze yields from government or corporate securities. In this case, gold is again appealing to investors.

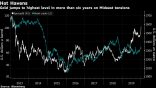

For the past five years, the resistance at $ 1,350 was too strong for gold to break it. This changed in June, when it became clear where the Fed's next course on monetary policy would be launched. Now gold is traded at around $ 1,440, and silver is also following.

The properties of gold as an investment asset to fight inflation are already in use. Gold is becoming more appealing in an environment where interest rates begin to decline, resulting in almost negative yields on bonds. The correlation between gold prices and mortgage interest rates is at their highest levels.

Even before the impact of inflation, the world of bonds rose to $ 13 trillion this month. Add the rise in prices and inflate the value to $ 25 trillion. It is even possible to pass over $ 30 billion if the Fed cuts interest rates twice this year.

Still, the profitability of gold is none. In fact, this is the initial asset that has a negative return. Storing gold on the vaults costs money. Some companies in London are charging their private customers with between 12 and 20 basis points of the metal value of gold for one year. Major clients, such as central banks, can secure your assets for 8 points. Similarly, buying ETFs also costs money. However, vault orders are rising.

Hedge funds continue to think that the price will continue to rise, but for the time being, the average long positions for precious metal futures are only 36%. This is still less than the figures in 2011, 2016 and 2017. This suggests that there is room for price rises and more funds are expected to allocate more money to gold.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.