- Home

- >

- Commodities Daily Forecasts

- >

- Gold is about to be offset by another equally valuable metal

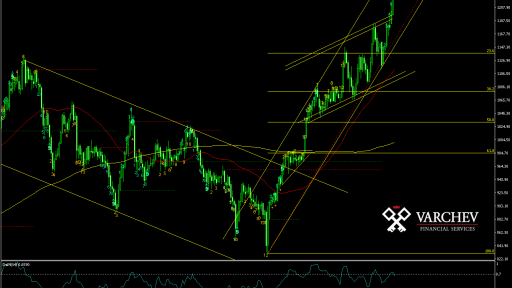

Gold is about to be offset by another equally valuable metal

Silver-white metal is approaching very close to dethrining gold as the world's most precious metal.

Palladium, which is used to filter the harmful emissions of gas-fueled automotive engines, has reached record levels. The price has increased by more than 25% in August and by about 10% for the year, making the metal the best-performing asset for 2018.

Meanwhile, gold is down by about 5% for the year as investors prefer the US dollar and US Treasury bonds as safe safe as long as stock volatility lasts. A strong dollar makes the metals more expensive for external buyers, and the prospect of higher interest makes gold less attractive asset.

This market dynamics also has an impact on palladium. But above all, the price is boosted by resource shortages and increased demand from the automotive industry. Last palladium rose to $ 1.1180 per troy ounce and gold fell to $ 1,245 per troy ounce. The difference between the two is at its closest point since 2002, according to Dow Jones Market Data. Thus, palladium metal is approaching to overtake gold and cause more cautious moves for gold investors.

Palladium also received support after the US and China weekend of the G20 meeting signaled a possible ceasefire and the start of negotiations to end the trade conflict, which has been going on for months. According to some analysts, the deal will stabilize demand from the automotive sector and many expect supply to fall by manufacturers such as Russia and South Africa.

It is precisely because of the risk of imminent palladium balancing that the market is prone to strong price changes, and investors and traders are expecting a sharp downturn if signs of an increase in supply appear.

Source: The Wall Street Journal

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.