- Home

- >

- Commodities Daily Forecasts

- >

- Gold prices will hit record high in next 18 months

Gold prices will hit record high in next 18 months

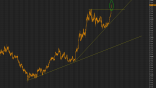

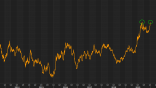

Gold prices may hit all-time highs in the next 18 months amid low to negative global bond yields, said a fund manager on Monday, joining a chorus of bullish calls on the safe haven commodity.

Despite being a non-interest bearing asset with holding costs, gold was attractive in the current climate where there was little trust in the establishment and its policies as demonstrated by the June 23 referendum in the U.K. when voters chose to leave the European Union, said Swiss Asia Capital's Singapore managing director and chief investment officer, Juerg Kiener.

The continued cratering of bond yields has also blunted the advantage fixed income instruments held over their shiny counterpart.

"This fall-off in trust is resulting in people looking at different ways to invest, particularly in an environment when the government controls the whole fixed income market, which is negative. At least (in gold), you don't have negative yields.

The yield on the benchmark 10-year Treasury note sat lower at 1.44 percent, while the yield on the 30-year Treasury bond was also lower at 2.23 percent.

Spot gold prices were trading around $1,350 an ounce Monday morning in Asia, about 27 percent higher year-to-date. Prices of the yellow metal hit all-time highs above $1,900 an ounce in August 2011.

Not everyone was so bullish on gold.

Credit Suisse's investment strategist Jack Siu said in a note late last week that the house had a neutral view on the precious metal with the price target at $1,300 an ounce in the next three months and $1,150 an ounce in the next 12 months.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.