- Home

- >

- Commodities Daily Forecasts

- >

- Gold wins new fans as U.S. inflation and Trump agenda falte

Gold wins new fans as U.S. inflation and Trump agenda falte

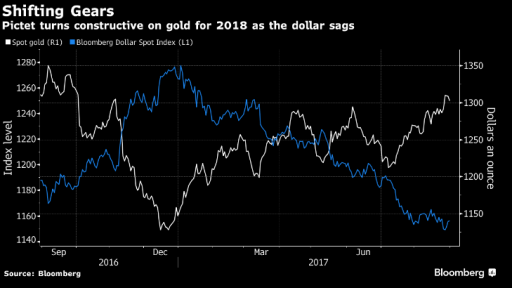

After nosing above $1,300, gold is winning new fans as tepid U.S. inflation anchors Federal Reserve policy and President Donald Trump’s growth agenda risks running into the sand.

The metal should trade above that level in 2018 as the dollar weakens and the Fed sticks to just two rate hikes, in December 2017 and then March, according to Luc Luyet, a currency strategist at Pictet Wealth Management, a unit of the Pictet Group, which managed $500 billion as of the end of June. Luyet’s “constructive” call is based on inflation lagging the Fed’s 2 percent target and Trump’s administration failing to deliver any significant fiscal boost.

“Given the fact that inflation should remain relatively low, we do not expect the Fed to be capable of doing much more than one hike in 2018,” Geneva-based Luyet said in an interview this week. “The dollar should be penalized next year by the weaker growth outlook and by the less active Fed, so we would expect the dollar to gradually weaken and that should support gold.”

In April, Luyet flagged the possibility of a retreat toward $1,100 an ounce, and had a neutral call on bullion. Gold has since rallied to the highest since November as conflict looms over North Korea’s nuclear ambitions, which has also hurt stocks and buoyed Treasuries. While such geopolitical uncertainties are difficult to predict, tensions between Kim Jong Un’s regime and the U.S. are supportive of gold, Luyet said.

Spot gold was around $1,305 an ounce on Thursday and the metal is 14 percent higher this year, while the Bloomberg Dollar Spot Index has lost 9 percent.

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.