- Home

- >

- Commodities Daily Forecasts

- >

- Goldman most bullish Wall Street bank on commodities

Goldman most bullish Wall Street bank on commodities

With the growth of economies around the world, the need for more and more raw materials is increasing significantly day by day. Despite all the "green" policies that are being conducted by governments around the world, world oil consumption is not declining, and even vice versa, consumption remains at record levels.

According to Jeffrey Currie and Michael Hinds, commodity analysts at Goldman Sachs, in 2018, copper and iron ore, along with oil will rise significantly. According to the two analysts at Goldman, "The environment for investment in raw materials is the best of 2004-2008."

According to the bank, rising raw material prices will lead to improved balance sheets for producers and creditors, and will lead to significant profits for emerging markets where much of the mines and oil reserves are concentrated. This, in turn, will greatly enhance global economic growth.

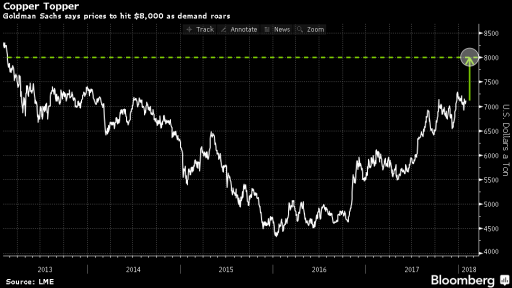

Goldman is the best-suited Wall Street player versus raw materials. Regarding copper, GS believes that the price of $8,000 per metric ton by the end of 2018. is completely possible. For comparison, Citi estimates that the average value for copper is about $ 7,125 per metric ton, and Deutsche Bank AG $7,175.

On oil, Goldman said Brent will rise to $80 a barrel by the end of the half-year as a result of increased demand and reduced supplies. Still, state mining remains in question.

Here's the detailed revised Goldman Sachs forecast for 2018.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.