- Home

- >

- Commodities Daily Forecasts

- >

- GOLDMAN SACHS: US shale will hit back at Saudi Arabia in 2017

GOLDMAN SACHS: US shale will hit back at Saudi Arabia in 2017

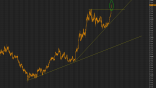

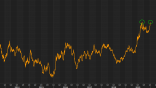

Even if OPEC and non-OPEC producers deliver the promised cuts and oil spikes to US$60, a recovering U.S. shale production would drag crude prices back to US$55, and the Saudis would be wrong to underestimate an American shale rebound next year, Goldman Sachs said in a report on Sunday.Oil at US$55 is the bank’s forecast for the first half of 2017.

The first half next year is the period in which OPEC and 11 non-OPEC nations promised to cut supply by almost 1.8 million bpd - 1.2 million bpd from the cartel and another 558,000 bpd from non-OPEC producers, including Russia.

Commenting on Saturday’s OPEC-NOPEC deal, Goldman analysts opined that greater than expected compliance or the Saudi pledge to make deeper cuts than they had already signed up for are two upside risks to the bank’s oil price forecast.

Last week, the number of oil and gas rigs in the United States was up again, with a massive increase of 27 rigs. Active oil rigs in the United States increased by 21 in the week to December 9, while the number of gas rigs increased by 6. The 21-rig increase this week represents the highest spike in the number of active oil rigs in the United States since July 2015.

As the current rig count stands, Goldman sees U.S. shale production already on track to increase quarter-on-quarter in the first quarter next year. With West Texas Intermediate crude at US$55, U.S. producers could be able to achieve an 800,000-bpd yearly growth in output .

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.