- Home

- >

- Commodities Daily Forecasts

- >

- he Great Corn Clash Is Coming as U.S., Brazil Farmers Face Off

he Great Corn Clash Is Coming as U.S., Brazil Farmers Face Off

The world’s biggest corn exporters are preparing for a showdown.

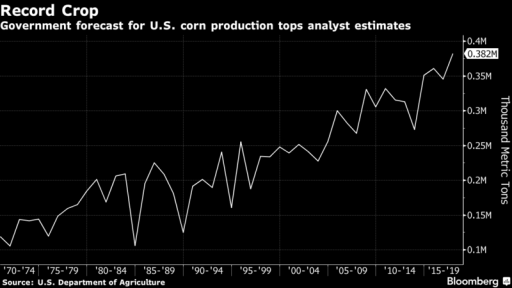

Brazilian farmers are in the midst of collecting their biggest corn harvest ever and American supplies are also plentiful -- setting the stage for a stiff battle to win world buyers in the second half of the year.

It’s a turnaround from just a year ago when U.S. exporters were seeing sales boom as a drought plagued Brazil’s fields. This year, the South American growers enjoyed much better weather and crop supplies have gotten so big that farmers are already short on storage after collecting a massive soybean harvest just a few months earlier. That’s giving exporters incentive to push corn shipments out quickly and could mean a squeeze for hedge funds that are betting on a price rally.

Competition has ramped up for farmers in the U.S., the world’s biggest grower and exporter. Brazil, which barely shipped any corn just two decades ago, has since emerged as a significant competitor. Sales are also on the rise from Argentina, which reaped a record harvest this season.A storage crunch is adding pressure on the market to move grain quickly as the corn harvest advances. The bumper corn harvest has driven domestic prices to the lowest in two years, making supplies attractive to importers.

The South American country’s success in stealing market share partly depends on moves for the Brazilian real and how many farmers are willing to sell crops at low local prices, said Paulo Molinari, an analyst at Safras & Mercado consulting firm.

Bloomberg Pro Terminal

Trader Velizar Mitov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.