- Home

- >

- Commodities Daily Forecasts

- >

- Hedge funds are less optimistic about Crude Oil

Hedge funds are less optimistic about Crude Oil

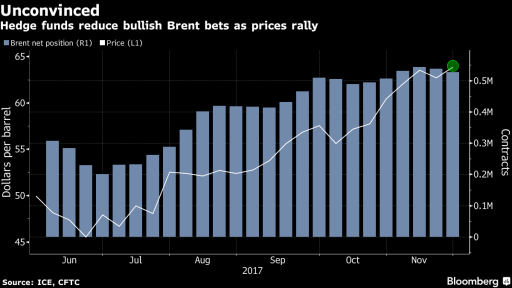

Opec upcoming meeting on Thursday, along with Saudi Arabia's arrests and conflicts, has sent the price of oil to new heights, but the hedge funds "play" that height with caution.

According to CFTC and ICE data, large hedge funds have reduced their net exposure for the second consecutive week, preparing for high volatility during the Vienna meeting. According to most market participants, the oil price has already reflected the expected agreement between the OPEC countries and the other major producers, and in the event of a collapse in the negotiations, the expectation for black gold to collapse again close to $50 a barrel.

Looking back at the time when OPEC made the same deal in May, futures had already risen by 10%, and after the actual deal, the price collapsed. Taking this into account, most managers will take preventive measures by expecting short positions to hedge in the days before the meeting. This will add to the price and in the event of a failure of the negotiations we expect a sharp decline. Large oil depreciation will also lead to weakness in CAD, but in the short term.

We are waiting for the OPEC decision, as failure of the meeting would give us enough reasons for Short, and if there is agreement, we expect a slight downward adjustment that will give us a good opportunity to enter with long positions on the trend. Following the OPEC decision, the main engine of the gold price will remain the US shale industry and the US oil export. At present, US exports manage to cover more than OPEC cuts and thus take a large share of the oil market in the world, and speculators artificially raise the price against the backdrop of an upcoming meeting - an additional factor supporting the short story. It is precisely because of the ever-growing US share of global oil trade that Russia is expected to withdraw from a new agreement.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Bloomberg: Hedge Funds Get Less Bullish on Brent Ahead of OPEC Meeting

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.