- Home

- >

- Commodities Daily Forecasts

- >

- Hedge funds with a record short on Gold and probably a short squeeze

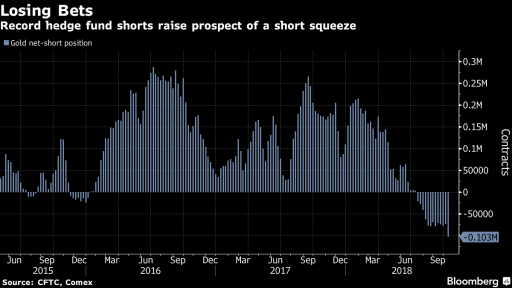

Hedge funds with a record short on Gold and probably a short squeeze

The Hedge funds, which last doubled their Gold positions, face a short squeeze.

The last price increase of precious metal is the fastest since Brexit vote. The combination of protection searches due to the fall in index prices and the seasonally strong purchasing period are the reason for this latest increase.

The last time hedge funds were record-breaking for gold, the price of precious metal rose 10%. An additional signal for possible positivism in the metal is the fact that ETFs (Exchange Traded Funds) have turned their position this month and are net buyers:

The price of gold and the net positions of ETFs are in strong correlation and usually, when net buyers, the price rises and vice versa.

From a technical point of view, the price has passed over a 100-day MA, and this may provide additional support and see a further increase in the price of the precious metal.

At the same time, the correlation between a strong dollar and a fall in the price of gold we have seen since the beginning of the year is weakening. If the fall in the price of the risky assets is resumed and the dollar does not continue to rise, this may weigh and support the Gold price which will lead to prices close to $ 1300 per ounce.

Despite these positive graphics for gold, there is also a negative one. Although Gold is a financial tool, it is primarily a raw material and the price can not be influenced by physical demand. The Indian rupee drops and that makes gold expensive, which may lead to a decline in demand, with India being the second largest gold buyer in the world. This may somewhat reassure the gold rally:

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Nikolay Georgiev

Trader Nikolay Georgiev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.