- Home

- >

- Commodities Daily Forecasts

- >

- Higher USD = higher oil price.. obviously this is the new rule

Higher USD = higher oil price.. obviously this is the new rule

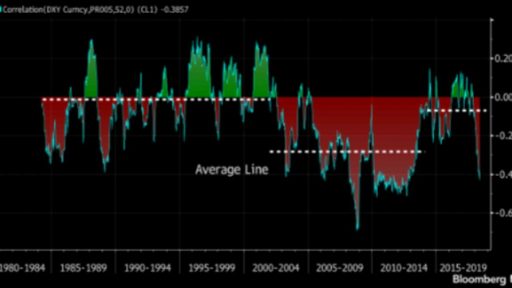

The simultaneous increase of crude oil prices and the dollar recently has defied the conventional wisdom that the two assets should move in opposite directions. Has the dollar actually become a commodity currency, now that the U.S. is a major oil producer thanks to shale?

The tighter links in the past were really an exception rather than the rule. Between 2004-2013, the correlation was consistently negative. That was the period where U.S. imports of petroleum products increased from $10 billion a month to $30 billion. Oil imports significantly widened the U.S. trade deficit, putting pressure on the dollar. Then the shale revolution helped U.S. oil production double since 2011 to almost 11 million barrels a day. Now that the imports have narrowed to $5 billion a month, it's not surprising that the correlation between oil and dollar has become a lot less stable.

While an increase in oil prices used to be a wealth transfer from the U.S. to Middle East exporters, it's now largely a shift of purchasing power between domestic oil consumers and producers.

There's another channel where oil prices can affect the dollar. On the margin, the Fed is more sensitive to some higher prices than others, given that the U.S. is further advanced in this economic cycle. But that marginal positive impact on the dollar to a certain degree is offset by OPEC countries. Flushed with greenbacks in their foreign reserves, they may need to sell some dollars mechanically, just to keep their currency composition in their reserves constant.

All in all, higher oil prices are less of a drag on the dollar than the past, but it's not necessarily dollar positive.

Source: Bloomberg Pro Terminal

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.