- Home

- >

- Commodities Daily Forecasts

- >

- Iron Ore Rout May Ease Off After Slump Brings $50 Back Into View

Iron Ore Rout May Ease Off After Slump Brings $50 Back Into View

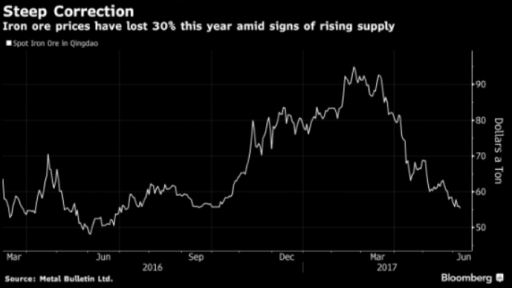

Iron ore’s rout may have pretty much run its course. With prices at the lowest level in almost a year after

dropping toward $50 a metric ton, the scope for further declines may be limited even as investors weigh the prospects for additional supply and bulging port stockpiles in China.

Over the remainder of the year, while prices may dip toward the $50 threshold, the commodity is expected to trade at about $60 to $65 a ton, according to Kash Kamal, an analyst at Sucden

Financial Ltd. The likelihood of a drop below $50 is limited, and in the near term, $55 to $60 should be fair, said Carsten Menke, an analyst at Bank Julius Baer & Co.

“The recent steep correction cannot be explained by fundamental factors alone, as the prior rally could not be explained by fundamentals either,” Menke said in an email.

“Prices sold off, although there is no fundamental impact on supply and demand in the short-term. Speculation always amplifies trends.”

Iron ore prices that peaked near $95 in mid-February have tumbled since then amid rising supplies from producers including Brazil’s Vale SA, and as China’s moves to clamp down on leverage

helped to spur a pullback in speculative trading in the largest user. The latest drop came after Australia’s Port Hedland, used by BHP Billiton Ltd. and Fortescue Metals Group Ltd., reported

record cargoes for May, and Brazil’s exports also hit a high for that month.

“Prices have actually overshot our Q2 target, but we anticipate this to be short-lived,” Kamal said in an email. Still, “with the recent stats coming out of Port Hedland, we anticipate increased competition among seaborne cargoes from Western Australia to keep a cap on spot prices.”

Ore with 62 percent content delivered to Qingdao dropped 1.1 percent to $55.43 a dry ton on Wednesday, the lowest since July, according to Metal Bulletin Ltd. After posting double-

digit falls in March, April and May, the commodity has lost 30percent this year. On Thursday, futures in Singapore and Dalian declined.

Among risk factors at present are the record holdings that have built up at China’s ports. The stockpiles have expanded 20 percent this year to 136.55 million tons as of June 2, near the

peak of 136.6 million a week earlier, according to Shanghai Steelhome E-Commerce Co.

“Given a well-stocked market, we expect spot iron ore prices to remain under pressure with slower demand growth unable to absorb excess material at a fast enough pace,” said Kamal.

“This under-pressure outlook is largely driven by ample port stocks of iron ore in China.”

Source: Bloomberg Pro Terminal

Trader - Senan Fuchedzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.