- Home

- >

- Commodities Daily Forecasts

- >

- Is 2008 Repeat?

Is 2008 Repeat?

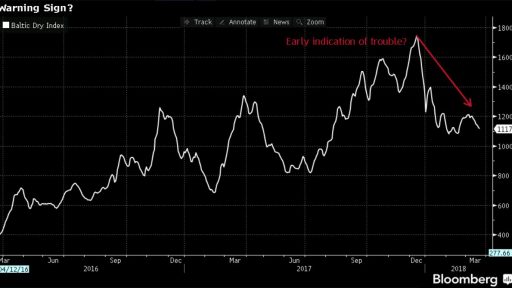

While the US import tariff plan for Chinese goods is still not in force, world markets have begun to reflect the worst-case scenario. What we are talking about are Chinese goods and, in particular, technological ones, but if we look at raw materials, we will certainly see something worrying. The prices of most of the world's raw materials seem to have just hanged and the upward trend will end. Experts are of the opinion that this may be an early indication of a slowdown in the economy.

"Such testimony in 2008 provided investors with an early warning of slowing growth." - said Simon Derrick.

The Baltic Dry Index, which measures copper, iron, and gold ore prices, has also started to halt shortly after Trump announced his plans for a trade war. In the months before the crash of the markets in 2008, the same question index fell by 30% in a very short time, giving the opportunity to react to a large number of investors.

What were the prospects for 2008 and what to expect now?

Just like those at the moment - promising! Trump is currently making noise, but in real terms, global economic performance is at a record level showing a healthy and promising global economy. Who pays for all this? If you ask the White House - the US and somewhat that is true, as the trade balance of the country with the rest of the world is negative. If we come out of the fact that Trump wants to end this practice, we will surely see a decline in world trade, which in itself will worsen economic performance on a global scale.

Source: Bloomberg Pro Terminal

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.