- Home

- >

- Commodities Daily Forecasts

- >

- Mixed US data and doubts about Brexit support gold

Mixed US data and doubts about Brexit support gold

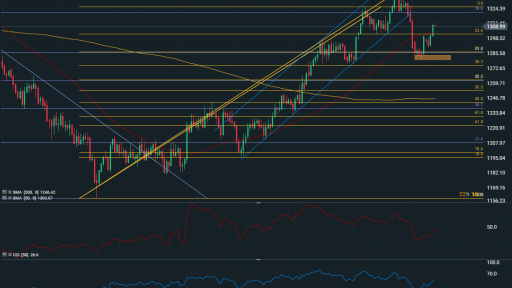

Gold reached a two-week high after a bit the "coolest" US economic data we saw yesterday. The appetite for gold was distorted by the presumption that, given the data, the FED would continue to wait, and the uncertainty surrounding Brexit additionally reinforced the precious metal.

Gold reached levels around $ 1310- $ 1311 per ounce, reaching its highest level since March 1st. The weaker PPI, along with the news from Brexit, has increased demand for gold.

Smoother data on inflation and disappointing PPIs will only support the FED's stand-by position for interest rates. This raises the price of gold because it is not tied to yields from interest rates. Traders buy, expecting the FED to confirm the position again or become even more dovish.

Gold managed to break the psychological barrier at $ 1300, with the weak dollar also helping to move upward. Precious metals may have to go up yet, given the still harsh geopolitical uncertainty and especially what is happening in the UK. If the $ 1300 barrier does not last, we can expect the downward movement to return. Up, the price could test the next zone at $ 1313.

Worrying about the slowdown in the world economy also reinforces gold.

Source: CNBC

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.