- Home

- >

- Commodities Daily Forecasts

- >

- Oil holds its biggest gain this year as U.S. supply drop surprises

Oil holds its biggest gain this year as U.S. supply drop surprises

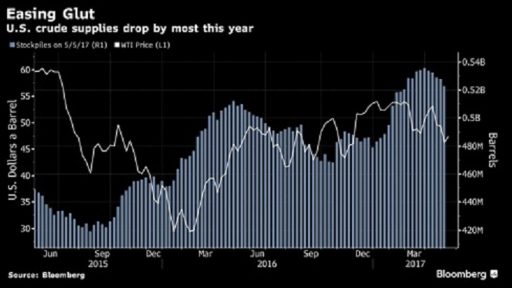

Oil held its biggest gain this year as U.S. crude stockpiles fell by more than twice what had been forecast, continuing a decline from a record and easing an inventory overhang.

Stockpiles dropped by 5.25 million barrels last week for a fifth weekly decline, according to government data. It’s the biggest fall this year and compares with the median estimate for a 2-million barrel decrease in a Bloomberg survey. Gasoline and distillate supplies also shrank, helping allay concerns over gaining U.S. crude output.

Oil is edging higher after last week dropping to its lowest levels since the Organization of Petroleum Exporting Countries agreed in November to reduce output. While Saudi Arabia and non- OPEC nation Russia signal they could extend cuts into 2018, concerns remain about the pace of rising U.S. supply, which the Energy Information Administration sees climbing to a record next year.

“The support that we see relates directly to the larger- than-expected draw on crude inventories,” said Michael McCarthy, a chief market strategist at CMC Markets in Sydney. “U.S. demand is a bit of a surprise factor for the market. Daily production has climbed again and stockpiles still remain very elevated, so that suggests this rally might not last too long.”

U.S. crude stockpiles dropped to 522.5 million barrels last week, down from a record 535.5 million barrels at the end of March, according to Energy Information Administration data.

Meanwhile production increased for a 12th week to 9.3 million barrels a day, the highest level since August 2015.

Source: Bloomberg

Jr Trader Ivan Ivanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.