- Home

- >

- Commodities Daily Forecasts

- >

- Oil lose steam, is this a return point?

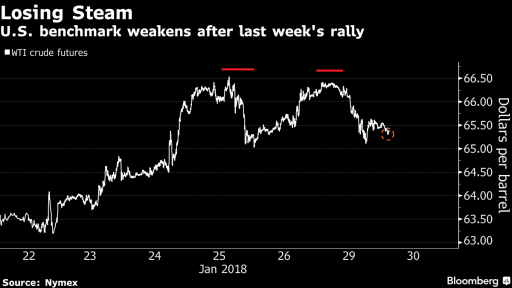

Oil lose steam, is this a return point?

The futures of one of the best-performing raw materials in the past year have been on the back as they are currently trading with a decline of over 2%

Although oil has risen by more than 7 percent since the beginning of the year, speculation that the rally is over does not stop. According to a large number of market participants, the fall in price is yet to come, as US mining and exports are at unseen levels for 3 decades and global consumption stays almost static. If we look at dry data in February, US exports will fully "cover" OPEC+ efforts, and it is very likely that we will see a resurgence of the downward wave in oil. Crude oil was largely due to the cheap dollar, which in the last few days began to show signs of promotion, both technically and fundamentally. If we see a reversal of the USD trend, the WTI pressure will pick up and growth over the last peak around $ 66 is unlikely.

Expectations for the oil reserves we expect on Wednesday are positive, and it is expected for the first time since November 10 last year to move to positive territory.

Seen by the big investors trading on NYMEX, the moods among them become more and more bearish. From the graph below, it is clear that bearish sentiment is close to the level of early December, and positivism has fallen sharply. 38.24% of NYMEX investors are set to decline, 35.29% are Long, and 26.47% remain neutral.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.