- Home

- >

- Commodities Daily Forecasts

- >

- Oil outlook for the week ahead

Oil outlook for the week ahead

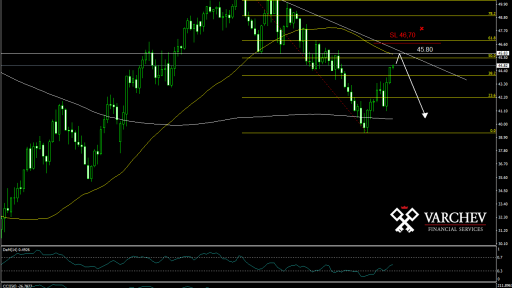

CL 15.08.2016

Fundamental analyses:

Latest release by Baker Hughes on Friday showed a 7th week in a row increase in rig count in USA. This is negative for the oil prices.

Latest increase in price is mostly based on rumors and expectations that OPEC will cap the production at a meeting on 26 28 September. So far Saudi Arabia also agree on some measures to stabilize oil market. This can sharply go in the other direction as a lot of same speculation went opposite.

D1 chart.

Price is near levels of resistance diagonal and horizontal.

CCI(50) still below 0 - negative signal

At H4 chart DeM(14) and CCI(50) are in overbought zone, as if CCI(50) goes below 100 or DeM reverse downward - this will give a confirmation for sell.

Possible short from 45,80

SL 46.70

Alternative scenario: Closed bar above the diagonal resistance will negate the negative scenario.

Jr. Trader Nikolay Georgiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.