- Home

- >

- Commodities Daily Forecasts

- >

- Oil price stays under pressure in mid term

Oil price stays under pressure in mid term

Fundamental analyses:

Latest data published Friday by Baker Hughes showed a sixth week of increase by rig count, which is negative for the oil prices.

NFP data from USA published on Friday was much better than expected which lead to USD increase. This will additionally pressure oil prices.

Technical analyses:

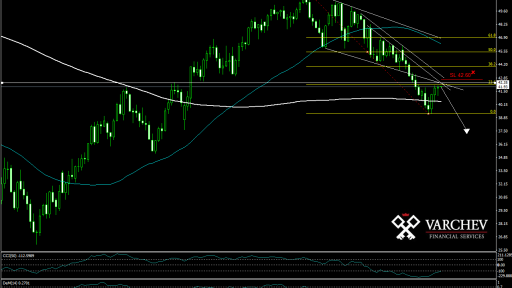

D1 chart.

Downtrend and correction up to 23,6 Fibonacci.

Price below diagonal and horizontal resistances

Price action: Hanging man at levels of resistance.

Technical indicators:

CCI(50) below -100 - negative singal

DeM(14) below 0,3 - negative singal

SL: 42.60

Alternative scenario: Break above 42.20 will activate Head and shoulders formation for probable increase

Economic releases during next week that will affect oil prices:

Tuesday, August 9: The American Petroleum Institute, an industry group, is to publish its weekly report on U.S. oil supplies.

Wednesday, August 10: The Organization of Petroleum Exporting Counties will publish its monthly assessment of oil markets.

The U.S. Energy Information Administration is to release its weekly report on oil and gasoline stockpiles.

Thursday, August 11: The International Energy Agency will release its monthly report on global oil supply and demand.

Friday, August 12: Baker Hughes will release weekly data on the U.S. oil rig count.

Jr. Trader Nikolay Georgiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.