- Home

- >

- Commodities Daily Forecasts

- >

- Oil prices could see a spike from a supply-demand imbalance, expert predicts

Oil prices could see a spike from a supply-demand imbalance, expert predicts

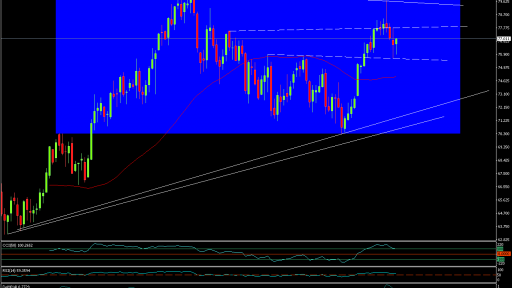

After cruising to four-year highs earlier this year, crude oil has hit the skids.

Since hitting $70 a barrel for the first time since 2014 in May, prices have been range-bound, but it could soon snap out of that range, according to energy expert Robert Raymond.

"We've sort of achieved [a recovery to the $70] level probably a little faster than we thought we would have relative to declines in Venezuela and Mexico and parts of China and so the production side of the equation has actually rolled over a little faster than we thought it would," Raymond, investment strategist at hedge fund RCH Energy.

Global inventories have since drawn down to border on "critical levels" as demand remains robust, explained Raymond.

The Organization of Petroleum Exporting Countries' (OPEC) spare capacity, which measures their bandwidth to ramp up production to cushion price fluctuations, is below 3 percent of total global demand. Lower spare production levels restricts how able OPEC is to respond to spiking prices.

Oil companies' re-investment and capital expenditure levels are also signaling a potential squeeze in supplies, he adds.

"The industry, for the last three years, has been chronically underinvesting and continues to do so at a rate of only 60 percent of cash flow being reinvested in the form of capex," explained Raymond. "The last time that happened [was] in 2004 and '05 which precipitated a spike to $147 a barrel."

Crude oil's next move also depends on how things shake out in the Trump administration's trade disputes, the analyst said.

"If some of this gets resolved in a relatively amicable or healthy way then the global demand curve holds together, then I think we have a real risk as we head into 2019 and beyond of materially higher prices," he added.

Oil demand growth is expected to rise by 1.64 million barrels a day to 98.83 million barrels a day this year, according to OPEC estimates. It should rise again to reach 100.26 million barrels a day in 2019.

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.