- Home

- >

- Commodities Daily Forecasts

- >

- Oil prices hold despite of US rigs increased for 22-nd week

Oil prices hold despite of US rigs increased for 22-nd week

Oil prices edged up on Friday from 2017 lows as some producers cut back on exports, but the market was poised for a fourth week of losses as OPEC-led production cuts failed to allay concerns over global oversupply.

Oil prices hit six-month closing lows on Thursday and have tumbled more than 12 percent from late May when producers led by the Organization of the Petroleum Exporting Countries extended a pledge to cut output by 1.8 million barrels per day (bpd) for six months by another nine more months.

"It's going to be difficult to have a rally unless there's a disruption or some news from OPEC," said Olivier Jakob, managing director with PetroMatrix.

Rising U.S. crude output has also undermined the impact of OPEC-led cuts, as production has risen more than 10 percent in the past year.

Data from the U.S. Energy Information Administration (EIA) this week showing growing gasoline stocks and shaky demand, despite the peak summer driving season, sent prices tumbling.

Eight prominent hedge funds have reduced the size of their positions in ten of the top shale firms in the Permian, the largest U.S. oilfield, by over $400 million, concerned that producers are pumping oil so fast they will undo the nascent recovery in the industry.

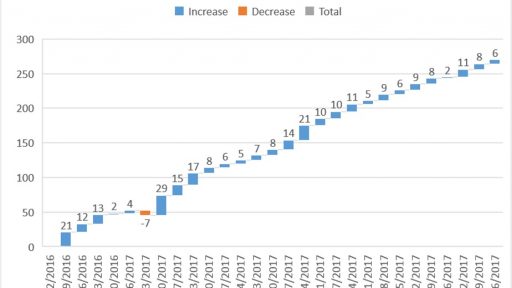

"Oil is unlikely to find solace into the weekend either, with ... Baker Hughes Rig Count expected to deliver its now weekly increase of operational rigs," said Jeffrey Halley, senior market analyst at futures brokerage OANDA in Singapore.

Source: Bloomberg Pro Terminal

Jr Trader Ivan Ivanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.