- Home

- >

- Commodities Daily Forecasts

- >

- Oil rises from 6-week low as U.S. glut eases, Russia backs cuts

Oil rises from 6-week low as U.S. glut eases, Russia backs cuts

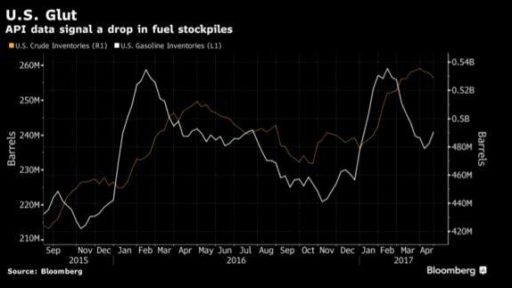

Oil rebounded from a six-week low on signs the U.S. crude surplus is easing and as Russia signaled support for longer production cuts with OPEC.

Futures in New York rose as much as 1.2 percent after closing at the lowest since March 21 Tuesday. U.S. crude inventories fell by 4.16 million barrels last week and gasoline dropped by 1.93 million, the American Petroleum Institute was said to report Tuesday. Russia believes that its accord to cut production alongside OPEC and other producers should be extended, a Russian government official said.

The API figures precede government data that will be released Wednesday, which is forecast to show a drop in crude inventories. Oil has fallen the past two weeks on concern that increasing U.S. output will offset efforts by the Organization of Petroleum Exporting Countries and its allies to eliminate a global glut. OPEC will meet again May 25 in Vienna to decide whether to extend the cuts through the second half of the year.

“The market mood, despite recent OPEC rhetoric, was bearish, and the API headline allowed oil at the end of the session to limit losses,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA in London. The market faces “a longer re-balancing period than most had hoped for.”

West Texas Intermediate for June delivery rose as much as 57 cents to $48.23 a barrel on the New York Mercantile Exchange and was at $47.96 as of 12:33 p.m. in London. The contract lost $1.18, or 2.4 percent, to $47.66 on Tuesday. Total volume traded was about 10 percent below the 100-day average.

Brent for July settlement gained as much as 68 cents, or 1.4 percent, to $51.14 a barrel on the London-based ICE Futures Europe exchange. The global benchmark crude traded at a $2.54 premium to WTI.

U.S. crude stockpiles probably fell by 3 million barrels in the week ended April 28, according to the median estimate in a Bloomberg survey of 11 analysts before an Energy Information Administration report on Wednesday. That would be a fourth week of declines.

OPEC deepened production cuts last month, with overall output dropping by 40,000 barrels a day, according to a Bloomberg News survey. Compliance among 10 OPEC members bound by the reduction deal strengthened to 102 percent from 89 percent in March, according to the survey of analysts, oil companies and ship-tracking data.

Russia believes that extending last year’s oil-output deal with OPEC makes sense for at least 6 more months given the current market situation, said a Russian government official.

Saudi Arabia will retain full ownership of its oil and gas reserves and sole decision-making authority on production levels after Saudi Arabian Oil Co.’s long-awaited initial public offering, according to Deputy Crown Prince Mohammed bin Salman.

Source: Bloomberg

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.