- Home

- >

- Commodities Daily Forecasts

- >

- Oil rises to new highs

Oil rises to new highs

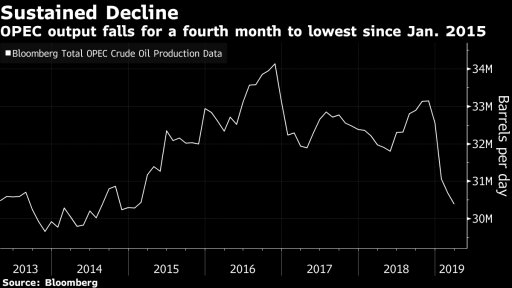

Oil climbed to its highest value this year after OPEC signaled tightening the oil market - a further cut in supplies.

The reduction in OPEC production stifles investors' profiteering, while Saudi Arabia exerts pressure to further reduce output, and frequent blackouts in Venezuela are already affecting local production. Oil stays in positive territory, despite the unexpected surge in US oil reserves last week.

"The foundation is on the oil side - OPEC reduces production, Venezuela's production problems, strong production data from the United States, and weaker oil production in the US, all of which suggest a further rise in oil prices." - says Phil Flynn, senior market analyst at Price Futures Group in Chicago.

Since the beginning of the year, oil has risen by 30%, precisely because Saudi Arabia has cut production, and fears of weak global economic growth are beginning to fade.

If on Wednesday the US oil inventory is also confirmed by the US government, it will be the second one in a row, raising doubts about the decline in stocks.

Forecasting oil supplies will remain difficult for a while, especially after the Houston Ship Channel problems at the end of last month. Parts of the canal were shut down after a fire broke into the chemical components storehouse.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.