- Home

- >

- Commodities Daily Forecasts

- >

- Precious metals have lost their shine as a safe haven for investors

Precious metals have lost their shine as a safe haven for investors

The rise in US interest rates three times this year, as well as an increase in ten-year bond yields, maintain the dollar's strength. And while the dollar remains strong, gold will continue to be under pressure.

In a sense, the markets for precious metals are experiencing the same difficulties and are largely influenced by the movement of the benchmark - gold.

If moods change, and for example, growth in the US is slowing down as a result of trade concerns, then gold can make progress. But as long as the dollar is a king, gold will remain weak, despite increasing tensions.

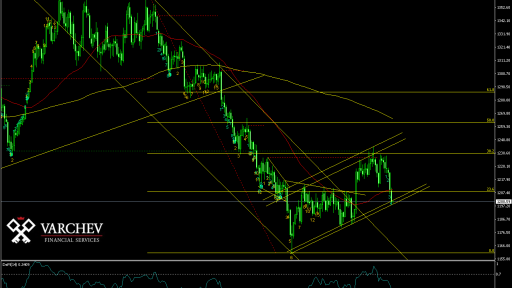

Gold prices ended their third consecutive loss session after the dollar again began to gain strength, which put a strain on demand for precious metals as a whole. A strong dollar and falling indices may have given us comfort in precious metals, but alas, market participants found havens in green money and the yen. The gold price reached the key levels of Fibonacci 38.2, but met a strong resistance, and after several unsuccessful attempts, the price turned south. $ 1200 remains strong support and psychological level. A breakthrough there would lead to a deepening of the downward movement.

The silver also followed the gold in the downward movement, barely holding over $ 14. With the deterioration of the foundation around the precious metals, we will certainly see further drops.

Silver will have to look for a closure below the bottom to confirm that the bears are still controlling, but if the blue zone as it once turned out to be a "vent" for silver, we can see a short-term correction.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.