- Home

- >

- Commodities Daily Forecasts

- >

- Rise on Oil amid positive expectation for OPEC meeting in Vienna

Rise on Oil amid positive expectation for OPEC meeting in Vienna

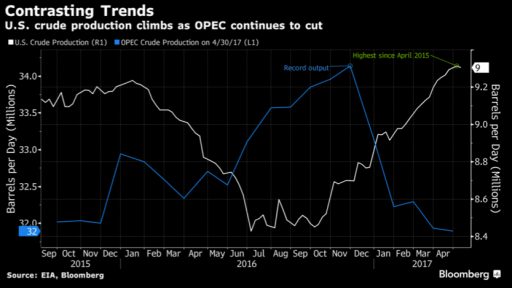

OPEC will extend an accord that trims production, even as surging U.S. output threatens the group’s

goal of draining excess supply, according to a Bloomberg survey. The Organization of Petroleum Exporting Countries and its allies will prolong the curbs for at least six months when ministers meet on May 25 in Vienna, according to 24 of 25 analysts polled this week. The respondents were split on whether the extension will last for six or nine months, and were also at odds over the probability of the cuts rebalancing the market.

Russia and Saudi Arabia, the largest of the 24 oil exporters that agreed to cut output for the first six months of the year, said on Monday that they favor a nine-month extension of the curbs. Prolonged curbs are needed to reduce global stockpiles to the five-year average, the energy ministers of the world’s biggest crude producers said. OPEC’s Kuwait and Venezuela, and non-members Oman and South Sudan support the proposal.

The world’s oil stockpiles increased slightly in the first quarter, but are set to decline in the second as demand picks up seasonally and OPEC constrains output, the IEA said Tuesday. Still, even if there’s an accord prolonging the measures, inventories will probably remain above average at the end of the year, the agency said.

Banks including Goldman Sachs Group Inc. and Citigroup Inc. say that even with the resurgence of U.S. oil production, markets are tightening and prices are poised to rise. The decline in global fuel stockpiles will accelerate this quarter, Jeffrey Currie, head of commodities research at Goldman said at the S&P Global Platts Global Crude Summit in London on May 10.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.