- Home

- >

- Commodities Daily Forecasts

- >

- Russia is dumping US debt and buying gold instead

Russia is dumping US debt and buying gold instead

Russia's ownership of US bonds fell from $ 96.1 billion in March to $ 48.7 billion in April and then to $ 14.9 billion in May.

On Tuesday, the US Treasury Department published a list of the 33 largest investors in US debt. Russia was among the top 10 in 2010 with a property of 176.3 billion dollars, but in May it ranked under Chile. The country began unloading US debt, with President Obama lifting sanctions against Russia in 2011.

Elvira Nabiullina, head of the Central Bank of Russia, said the reduction was due to an assessment of the financial, economic and geopolitical risks. Nabiullina said purchases of gold have contributed to the diversification of Russian wealth.

Padhraic Garvey, chief strategist for debt and interest rates at ING, said that what Russia is doing is "switching from a safe asset to extremely safe."

Russia buys large amounts of gold as it continues to sell American bonds, and has recently overtaken China as the largest holder of 80.5 billion dollars, according to the Russian central bank.

The US currency is under increasing pressure in 2018 after US debt rises.

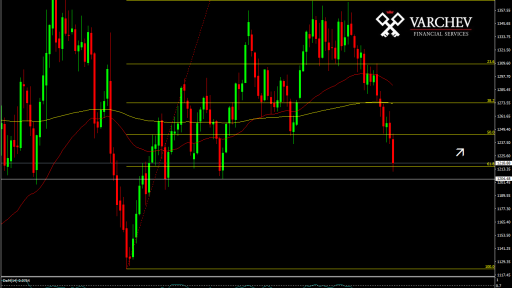

On weekly chart, we have strong support with Fibonacci 61.8%. DeM also shows that the precious metal is over-sold. There has been no correction for the last 7 weeks. Trump's comments are not satisfied with the way the Fed is conducting its monetary policy, it can weaken the dollar, which further creates the prerequisites for correcting gold.

Source: Business Insider

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.