- Home

- >

- Commodities Daily Forecasts

- >

- The recovery in oil remains questionable

The recovery in oil remains questionable

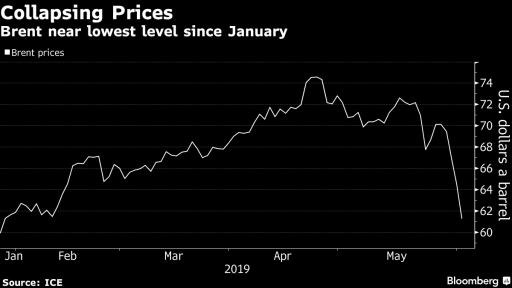

For the time being, oil is at a level of a few cents to record a four-month low. Rebound in prices followed the comments on expectations OPEC that it will continue to restrict production in the deal because of concerns that demand will decline significantly from global economic risks.

Futures on Brent Brent remained barely above $ 61 a barrel, after earlier in the week reached its lowest level since January. Vitol Group, the world's largest oil trading company, expects OPEC + to extend its agreement in the second half of 2019. Saudi Arabian Energy Minister Khalid Al-Falih said it would work on stabilizing markets. JPMorgan, in an attempt to avert hopes, said they had a 40 percent chance of recession in the US in the second half of 2019.

Since its peak in April, oil is down nearly 20%, almost entering the bear market. That is why it helped trade tensions between the US and China and the announcement of new tariffs on Mexican goods. But the market finds support from the tight supply and the existing risks to the extraction from Venezuela and Russia. This month's OPEC meeting is due to comment on the forthcoming mining policy and the geopolitical situation.

Last month, Saudi Arabia had to pick up the extraction to compensate for the lack of activity from Iran after production peaked at its lowest level since 1990 as a result of the US sanctions.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.