- Home

- >

- Commodities Daily Forecasts

- >

- Trump wants cheap oil, but IMF data show that Saudi needs higher prices

Trump wants cheap oil, but IMF data show that Saudi needs higher prices

Saudi Arabia needs higher oil prices to secure its costs by stimulating the economy and this is contrary to the wishes of Trump.

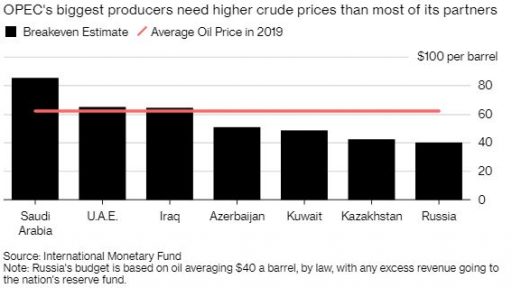

IMF data released on Monday show that the world's largest oil exporter needs prices of around $ 85 a barrel to balance its budget this year, compared with a forecast of $ 73 in September.

The assessments highlight the difficult task of Crown Prince Mohammed bin Salman to build a close relationship with Trump and at the same time revive economic growth and job creation in the kingdom through the 2023 program, which includes a 7% increase in government spending in 2019.

Trump has repeatedly warned OPEC to keep oil prices low, and his latest tweet Friday said he was talking to Saudi Arabia and other suppliers about production.

Many members of OPEC and their partners outside the group will report a budget deficit if the price exceeds the average of $ 62 by the end of the year. Saudi Arabia expects to reduce its deficit to 4.2% of GDP from 4.6% in 2018 due to high supply prices.

Saudi Arabia's fiscal break-even is likely to be above $ 95 a barrel this year, but IMF is likely to calculate a cash transfer from Saudi Aramco to the finance ministry. " Ziad Daoud (chief economist- Middle East) told Bloomberg.

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Velizar Mitov

Trader Velizar Mitov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.