- Home

- >

- Commodities Daily Forecasts

- >

- UBS: “We Stay Long on Gold at least to $1600”

UBS: "We Stay Long on Gold at least to $1600"

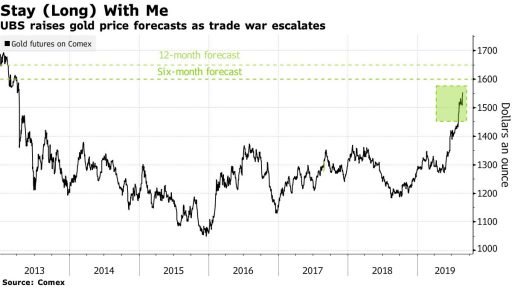

Gold will continue its uptrend as US-China opposition is damaging to growth, which is already in question, according to UBS Group. The bank has updated its precious metal forecasts, saying it will remain at least as high as $1600.

The trade war between the United States and China has escalated to new levels, and gold has proven its worth as a haven, said Giovanni Staunovo from UBS's Wealth Management.

Where and when UBS expects gold to reach:

- By the end of Q3-2019, the bank's expectations are in the range between $1,450 and $1,600 to maintain.

- By the end of 2019, prices above $1600 will be fully in tune with the current economic situation in Germany/Europe and possibly a continuation of the US-China trade dispute.

- In the next 12 months, the bank is of the opinion that prices will move near $1,650 per troy ounce, and it is good to note that until a month ago the bank was of the opinion that in the summer of 2020, the fair value of the valuable metal will be close to $1500.

The risk, of course, remains, and it is at any time that Trump can change course and move closer to China. Something we should expect in view of the upcoming 2020 elections.

Source: Bloomberg Finance LP

Chart: Bloomberg

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.