- Home

- >

- Commodities Daily Forecasts

- >

- Wall Street Hedge Funds for platinum: “Sentiment changed to Long”

Wall Street Hedge Funds for platinum: "Sentiment changed to Long"

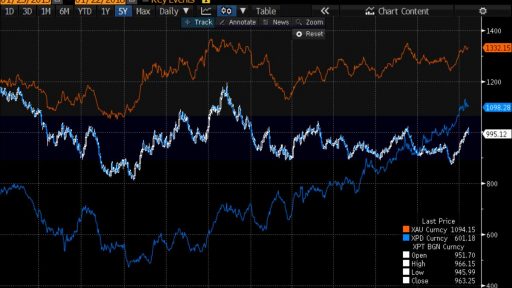

Since platinum was lagging behind other precious metals in 2017, the precious metal finally made its Long Long request and the Hedge funds noticed this. The big Wall Street and City of London fund managers increased their bets for platinum to rise in the coming months, mainly because of the new stricter emissions standards in China. This, along with the weakening US dollar, fundamentally changes the sentiment of the metal.

In the week ending 19th, hedge funds raised their net long exposure with 5835 contracts to a total of 33 165 contracts, while short positions declined by 14%.

In the week ending 19th, hedge funds raised their net long exposure with 5835 contracts to a total of 33 165 contracts, while short positions declined by 14%.

Stricter emissions standards in China include lower pollution limits set this year for all diesel cars, which will mean higher use of platinum catalytic converters to meet the requirements.

As catalyst production is expected to grow significantly, platinum stocks will hit a record low. This year's demand for demand is to exceed the supply by about 275,000 ounces. On the other hand, South African companies, which account for over 70% of world production, are experiencing difficulties. Since most companies operate with US dollars, the decline in currency leads to a significant increase in production costs. Any breaks in the work of these mines may lead to a significant increase in the price of platinum.

Individual investors also accumulate long positions in ETFs tracking the metal price. According to Bloomberg, one of the largest ETFs, the New Gold Platinum ETF enjoys the largest Cash Inflow in its history - $2.54m.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.