- Home

- >

- Commodities Daily Forecasts

- >

- What does the low cost of oil to the world economy mean?

What does the low cost of oil to the world economy mean?

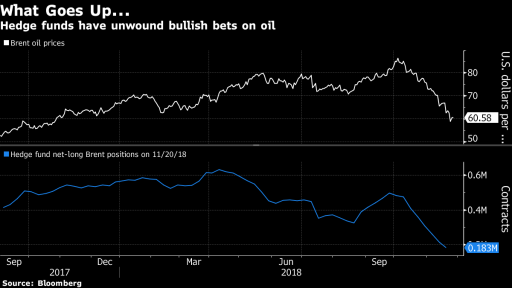

Just a few weeks ago, the big Wall Street players assured us that the WTI's price will again rise to over $ 100 a barrel, but today at a price of around $ 51, it seems less likely. Now at half as low as expected, let's look at what it means to the world economy.

In a few words, net importers such as India and South Africa will benefit, while producers like Russia and Saudi Arabia will again suffer colossal losses. It is also useful to add that some central banks, such as Bank Of Japan, will, for example, revise their policy of raising the key rate. The fall in the price of oil makes the world economy difficult, and this would cast doubt on central bankers.

Ultimately, much depends on how global demand for oil is developing, which, despite the low prices, remains weak because of the strong dollar and the slowing world economy - at least according to headlines.

Within a few hours, Donald Trump's meeting with Xi Jinping is about to be traced too short.

What does this mean for oil and what about indices?

If we observe a soft tone and will to solve the problem of tariffs, the indices will be the most profitable for a number of reasons. On the one hand, the retention of tariffs or their total elimination will lead to a strong upheaval in stock markets, and on the other, oil will rise as the main reason for the slowdown in the economy is precisely US-China import tariffs. Considering that the energy sector has the largest share in major stock indices, oil growth will add extra strong to their upward momentum.

On the chart below, we can see how the low oil price influences the country's GDP:

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.