- Home

- >

- Commodities Daily Forecasts

- >

- WHEAT (CMD) opportunity to sell on the trend

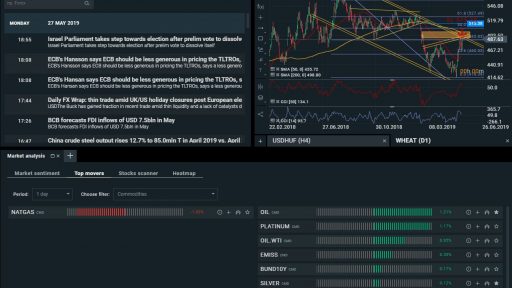

WHEAT (CMD) opportunity to sell on the trend

Instrument: WHEAT

Timeframe: D1

Technical comment: We see a long-term downward trend in wheat after a period of choppy movements. The large bearish triangle from autumn 2018 to early 2019 has catalyzed the latest downward momentum, which is currently undergoing a correction. We expect it to close at current market levels once the price has already entered a resistance zone at a diagonal and a 38.2 Fibonacci level. The price remains below the 200 - day period and opens up a trend sale opportunity.

STOP LOSS 515.38.

Fundamental commentary: Wheat remains depressed due to the trade war as most agro-tools that are dependent on trade with China. Short-term demand is driven by a certain impulse in seasonality, as weather is warming up, signs of possible drought are created, resulting in stronger demand. Time, if it is not a factor this year, however, the export levels will certainly be. The prerequisite for selling here is not only because of the technical indicators but also on the hypothesis that the demand will significantly decrease due to the lack of buyers of the raw material.

Alternative Scenario: The prerequisites for our bearish scenario break up as demand increases. The bearish variant drops out in a strong breakthrough in the resistance zone, where the price will make an attempt to rise to 506.66.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.