- Home

- >

- Commodities Daily Forecasts

- >

- Why gold investors should look at silver too?

Why gold investors should look at silver too?

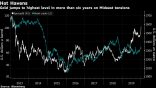

Silver prices hit a two-year high above $21 per ounce on Monday, as precious metals continue to gain from the safe-haven rally following the U.K. referendum.

Some investors say silver has further to run and may be a better bet than gold.

"Silver is a metal that most people don't really think about when they think about precious metals, but it does have this dual property towards both an industrial metal and a precious metal. So many of the reasons that investors chose to invest in gold, silver has many of those properties, at the same time as having a lot of demand coming from industrials," PureFunds CEO Andrew Chanin said.

Despite recent gains, silver prices remain around 60 percent off a 2011 peak above $49 per ounce. This, combined with the metal's low price relative to gold at present, suggests the rally may have further to run.

"If you use the silver-gold ratio to look at historical prices versus where we are currently at, for each ounce of gold that is mined, roughly a little less than 10 ounces of silver is mined, but the ratio is trading at over 70:1 and it seems like there may be an opportunity. Historically, that average has been closer to 40, or even lower if you look at a long time period," Chanin said.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.