- Home

- >

- Commodities Daily Forecasts

- >

- WTI with potential for short

WTI with potential for short

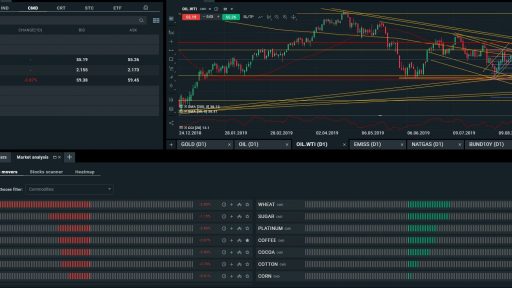

Timeframe: D1

Instrument: OIL.WTI (commodities)

Technical comment:

Oil remains in the downward movement, and after a short period of short-term consolidation we have the first conditions to take a short position. We have a previous unsuccessful attempt to test the 200-period candle-hammer closure and knock-down levels at $ 57.35, as well as diagonal resistance. The price for now manages to keep below the 200 period and below Fibonacci 23.6 (colored in blue). The CCI indicator goes below level 50, confirming the bearish signal.

Fundamental comment:

Higher oil stocks indicate that demand remains weak, suppressed by fears of a slowdown in the global economy. Fears still fueled by the trade war. Small-scale conflict in the Middle East at this stage cannot trigger a more aggressive and medium-term upward movement. Market players remain reserved regarding the demand for natural resources.

Potential deal: SHORT based on a technical analysis supported by a fundamental justification. Volume Refinement and STOP LOSS $ 59.15. Entry after waiting for the closing of the current bar to confirm closing below the 200 period and 23.5 Fibonacci retracement. Closing below the recent diagonal line with full body will be an additional bearish confirmation.

Alternative scenario: Bulls manage to pull the price above the 200 period and levels above 58, which ruins our bearish scenario. In this case, the upward movement would have the potential to continue to levels at $ 60.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.